Well now that the US mid-term elections are out of the way, there is now no compelling and urgent reason for the price of crude oil down be under $60.....

Well now that the US mid-term elections are out of the way, there is now no compelling and urgent reason for the price of crude oil down be under $60..........oops! Did I insinuate something there? Nah! I'm sure it was just normal market forces :)

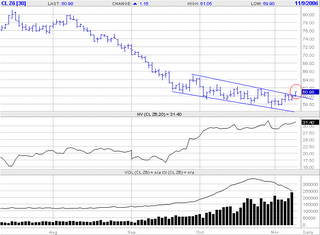

Anyway, Oil has broken out of its downtrending channel (with Unleaded and Heating Oil looking similar) as indicated on the chart.

IV is rock bottom of its two year range at 26% and with Statistical Volatility at 31%, options look cheap here. Any long vega, long delta strategies look good to me.

18 comments:

Hiya Howard,

Thanks, and thanks for linking. I will do likewise.

I think oil will be a good long... just a matter of being on it when it fires I reckon.

Cheers

Neat! Got here from Howard's site. Good to see some futures action every once in a while as opposed to the stock market or options market, keeps my reading "diversified."

Curious: What is your linkup on the charts for expiration? And how do you roll over (or decide to) at expiration?

Bill,

Wow this is really cool. I never thought anyone would ever read this...and finding great blogs for me to read in the process. I'll blogroll you :)

Just want to clarify your question; Are you refering to the charts on the site, or if if in a trade, when to role the trade out to the next contract?

Cheers

Oil lifting after the election? Coincidence is right, lol.

Best of luck.

I'm familiar with the concepts of LTTF applied to futures contracts from studying the Turtles. I'm aware that charts of futures prices are "adjusted" for expirations, but I am NOT aware of (1) the methods used or (2) the pros and cons of the various methods. That was question one.

Question two was how you decide to roll over (or not) and how you transition it.

From the research I've done, semi-automated futures trading seems like a good deal, if one has both enough capital to simultaneously trade many markets and enough huevos to ride the drawdowns. But, I'm still a newbie at the futures markets and will probably stay that way until I feel entirely comfortable with stock …

Yep, lots of good blogs out there. Check out my links page and you may find more that you like …

I like this one Adam -

Coincidence is the word we use when we can't see the levers and pulleys.

Emma Bull

Hmmmmmm

Bill

Question 1: For any short term analysis for minor swing trades one can just stick to the actual contract traded.

For more long term analysis spanning the life of several contracts, there are two basic methods, both with advantages and drawbacks.

1/ Spliced: The contracts are just tacked together without adjustment. This often means there can be a gap (sometimes substantial) where one expires and the subsequent contract picked up.

This method is useless for backtesting with software. But it is the best method for looking at long term support and resistance levels

2/ Back adjusted: This takes the current contract as the basis for price and adjusts all expired contracts to remove the gaps at rollover, so there is a continuous chart.

This is good for backtesting trading systems with software, but is useless for long term support and resistance. As an example, with some commodities, there will be negative prices way back in the adjusted contracts.

There are other methods of handling this but these are the main two.

Question two: Well there are two types of contract which will affect how i handle this.

1/ Physical Delivery Contracts. Contracts such as gold, oil, grains , softs, are physical delivery and as such, you need to be mindful of not ending up with several silos worth of corn dumped on your front lawn. lol (That's not how it works, but it sounds dramatic)

Some time before expiry (about a month). A "notice" period commences where delivery is to be organised between you and your broker. You DO NOT want to be holding physical delivery going into notice period. So logically you flip it out to the next contract before then.

You will know this is approaching (even if you don't know the exact date)by watching the open interest. OI will taper off dramatically in the few days before notice. You will see in the Dec Oil chart I posted, the OI is starting to drop off. It is getting close to the notice period and traders are starting to roll out.

2/ Cash settled contracts. Contracts such as Lean Hogs, currencies, treasuries, indecies etc are cash settled and there is no delivery involved. These can be safely held till expiry or flipped out any time before.

Not withstanding that, I want to be in the most liquid contract, so if OI starts to peter out, and I think I'll be holding the position past expiry, I'll roll.

Hope that answers.

Cheers

Hmm. Since stocks gap all the time, and indicators and regressions and trendlines work on them just fine, I don't see how the gaps would impact a spliced futures graph. Maybe I'm dense on that.

OK, so (hypothetically) if you always splice the data without adjustment at some arbitrary point where OI usually starts to fade, say ___ days out from notice and/or expiry, you could run models on that data and then trade based on that, if you managed your change over according to the pattern you used to splice.

Sorry to monopolize these comments, but trying to work this out in my head.

No problems Bill, :)

The gaps in a stock will have some sort of value basis revealed by news, earnings etc, and as such, a huge gap down, for example, could be viewed as an over-reaction or oversold.. or the start of a new downtrend or whatever, but it will have a logical reason.

The rollover gaps in a continuous futures chart however, are more to do with issues such as carrying costs, old crop-new crop, or issues affecting back month contracts and not front month contracts. (or visa-versa) For all intents and purposes, these gaps do not really exist in the same sense as stock gaps.

Personally, I *try to keep my analysis to the contract being traded, and only refering to the continuous spliced contracts for longer term support and resistance. But that may not be suitable for a systems trader.

As far as testing systems goes; well if you have the programming ability, you could create an adjusted chart based on open interest and volume, that could be tailored to the individuals trading style, but this is well past me.

There is another adjustment method called a "perpetual" chart which gives a mathematical weighting according to open interest. But I have no experience with these, so can't really give an opinion.

It does create issues for systems traders and I don't think there is any perfect solution, but an ordinary spiced chart would seriously mess up your backtesting.

Cheers

I dont get what the election has to do with it? Do you actually think W,reps,or oil companies control the price of crude? Maybe I misunderstood ya.

soonenough,

I guess there are two schools of thought on that.

Certainly sub $60 oil would be seen as useful to the GOP cause, and the coincidence is striking.

As to whether W and co. could have actually manipulated it? Who knows! Just a bit of whimsy really.

There is a coherent proposal as to how it could have been done, but I haven't researched it myself.

If Goldman Sachs were to have reweighted their commodities index, to reduce the weighting of oil, then that would imply a selling of oil contracts. GS wouldn't actually lose any money doing this: they would be playing with OPM and the suckers in that scenario would be holders of the GS commodities products.

Why would GS do that? Go figure!

wow gold

wow gold

wow gold

wow gold

World of Warcraft Gold

rolex replica

wow power leveling

wow power leveling

wow power leveling

wow power leveling

wow power leveling

wow power leveling

wow power leveling

power leveling

power leveling

power leveling

rolex

rolex

power leveling

power leveling

power leveling

wow powerleveling

wow powerleveling

wow powerleveling

wow powerleveling

wow powerleveling

wow powerleveling

powerleveling

powerleveling

powerleveling

wow gold

powerleveling

powerleveling

powerleveling

World of Warcraft Gold

World of Warcraft Gold

World of Warcraft Gold

World of Warcraft Gold

World of Warcraft Gold

wow power leveling

wow power leveling

wow power leveling

wow powerleveling

wow powerleveling

wow powerleveling

rolex replica

Warcraft Gold

Warcraft Gold

Gold wow

Gold wow

Gold wow

Gold wow

Warcraft Gold

Warcraft Gold

中高年 転職

アルバイト 求人情報

ブライダル

転職

競馬

FX

ダイエット

お見合い

競馬 予想

新築マンション

新築マンション

コンタクトレンズ

婚約指輪

合宿免許

人材派遣

東京都 墓地

派遣会社

人材派遣

パチンコ 攻略

おなら

货架

OCR

OCR

手机词典

高速扫描

机票

灭蟑螂

蜗轮减速机

减速机

齿轮减速机

丝杆升降机

租房

租房

北京租房

北京租房

搬家公司

北京搬家

北京搬家公司

上海机票

上海机票

上海打折机票

上海打折机票

上海特价机票

上海特价机票

搬家公司

搬家公司

北京搬家公司

北京搬家公司

xzvxfgdfhjd

美容

美容手册

护肤养颜

护肤心得

美肤法宝

美丽肌肤

毛孔粗大

祛痘祛印

控油净脂

去角质

保湿

防晒

抗皱

祛斑

眼袋

美白

面膜

彩妆天地

化妆技巧

化妆用品

时尚妆容

靓丽彩妆

粉底

睫毛

描眉

眼妆

腮红

美甲

卸妆

补妆

秀发一族

秀发DIY

时尚发型

美发护发

美发用品

医学美容

疾病与美容

专家提醒

整形美容

中医美容

饮食美容

香氛迷情

香氛物语

香水品牌

整形美容

整形知识

整形新闻

五官整形

口唇整形

眼眉整形

颧骨整形

鼻部整形

耳部整形

颌面整形

牙部整形

乳房整形

变性手术

女性性器官整形

男性性器官整形

美体瘦身

瘦身快报

减肥常识

认识肥胖

肥胖危害

肥胖原因

肥胖预防

减肥方法

瘦身饮食

运动减肥

中医减肥

吸脂减肥

药物减肥

其它减肥方法

局部瘦身

面部瘦身

四肢瘦身

纤纤细腰

性感翘臀

腹背健美

明星瘦身

塑身美体

丰胸美容

丰胸

保湿

美白

防晒

抗皱

控油

除痘

祛斑

职场风云

职场传真

职场攻略

薪资行情

职业装扮

心语故事

流行风尚

时尚看点

服饰潮流

时尚饰品

香水广场

不動産 買取

マンション 売買

土地 売却

札幌 不動産

仙台 不動産

大阪 不動産

横浜 不動産

名古屋 不動産

福岡 不動産

京都 不動産

埼玉 不動産

千葉 不動産

静岡 不動産

神戸 不動産

浜松 不動産

堺市 不動産

川崎市 不動産

相模原市 不動産

姫路 不動産

岡山 不動産

明石 不動産

鹿児島 不動産

北九州市 不動産

熊本 不動産

SEO対策

投資

土地 査定

無料 出会い 競馬予想 無料 競馬予想 競馬予想 無料 競馬予想 無料 競馬予想 無料 近視 手術 メル友 出会い 出会い 出会い 出会い メル友 メル友 人妻 メル友 ギャンブル依存症 AV女優 無料 出会い 出逢い 掲示板 出会い系 無料 出会い 人妻 出会い 人妻 出会い セフレ 人妻 出会い セックスフレンド メル友 出会い SM 愛人 不倫 セフレ 無料 出会い 出会い系 無料 無料 出会い 富士山 写真 富士山 メル友 無臭性動画 カリビアムコム 一本堂 出会い 人妻 セックスフレンド ハメ撮り エッチな0930 メル友 無料 出会い 無料 出会い セフレ セフレ セフレ セックスフレンド セックスフレンド セックスフレンド 人妻 出会い 人妻 出会い 人妻 出会い 出会い系 出会い系 出会い系 カリビアンカム カリビアンカム

I am working at Rsorder.com, which is providing cheap runescape gold ,rs items, runescape money , rs account and rs powerleveling with fast delivery.What you say is very funny and your thought rs gold is so new , which is also easy to be understood. However, i also want to say i am hope for more here. Better to remain silent and be thought a fool that to speak and remove all cheap rs gold doubt.

Post a Comment