Thursday, December 21, 2006

Copper Update - Plus Everything Else

I also thought I'd update some of the calls and observations I've posted here over the last few weeks.

The dollar index, the set up which I was most excited on Tuesday about has stalled over the last few days. But the setup is still valid and yet to be disproved.

Silver sold off hard last Friday and continued down on Monday. Has since been a small consolidation zone, but looks like it could continue down.

Gold is still not showing any clear trend at the moment, but if the other metals continue down, it could follow suit. This is counter intuitive to the dollar downage... so we'll see.

Cotton which broke out of a rough basing pattern last Friday on very low IV, is continuing to look bullish. Not a parabolic trend, but very workmanlike.

Orange Juice - Rumours of OJ's demise have been greatly exaggerated. I was a tad enthusiastic in calling a top there... buuuuttt at least it hasn't bolted higher and humiliated me.

Cocoa is still looking bullish, but some profit taking eveident.

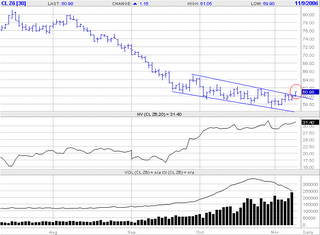

Crude. You knew I meant NEXT Christmas, right?

Coffee. Made enough to pay off my tab at the local Cafe'.

This will be my last post before Christmas I think, so HAVE A GOOD ONE!

Wednesday, December 20, 2006

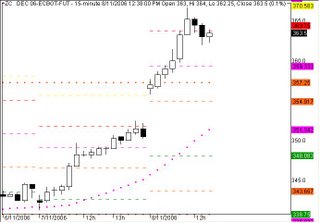

Copper Cropper

Regular readers of this blog will notice that I have given a lot of attention to copper futures over the last 6 weeks or so. The reason is that I think it could be a good leading indicator for the health of the US/western economy - China story interplay. The precious metals have currency/inflation implications affecting price, and equities..... well in my opinion that's fantasy land affected more by spin than economic factors.

Regular readers of this blog will notice that I have given a lot of attention to copper futures over the last 6 weeks or so. The reason is that I think it could be a good leading indicator for the health of the US/western economy - China story interplay. The precious metals have currency/inflation implications affecting price, and equities..... well in my opinion that's fantasy land affected more by spin than economic factors.Copper is not greatly affected by these factors; BubbleVision doesn't talk about it much, if at all, so it is a pure supply and demand play... give or take the odd hedge fund trade.

For quite a few months I've held the view, and I'm not alone in this, that the copper story is all over for now, that we'll see lower prices going forward.

The thing is, since the low at around $2.97 per/lb printed during the retracement from the high of the year, copper futures have been doggedly supported at this, and points north.

On Dec 7, I posted up a chart of where I thought copper *might* go over the short term and this seems to be going according to script... at the moment anyway. March Copper futures today have broken below that $2.97ish support.

On Dec 7, I posted up a chart of where I thought copper *might* go over the short term and this seems to be going according to script... at the moment anyway. March Copper futures today have broken below that $2.97ish support.Now, it's not a convincing break by any stretch of the imagination and it could even finish the day back above support. I also fully expect buyers to show up at some stage over the next few days anyway, so this "scenario" will still need some time to play out and either confirm itself, or for buyers to come in and support it for a while longer.

In any case, this really adds to the hypothesis I'm working on and I think this, as a leading indicator, is looking just that bit more bearish for the overall western economy.

Just my opinion folks.

Tuesday, December 19, 2006

The Dollar - Sometimes Technicals Just Work

What keeps us technicians faithful to the craft, despite bad calls, satire, ridicule, derision (OK it's not that bad, but the fundies do like to dish it up to us) is that at times, all the planets line up just right and the confluence of factors is so stunning that you just have to trade it. This setup on the Dollar Index has it all.

We have:

* old support becoming resistance

* reaction off the downward sloping trendline

* confluence of fib levels

* evening star candle pattern

* all occurring at pretty well spot on the 83.80 level on the March contract

...and it's taken a whopping off that level today.

To say that I like this setup is an understatement. They don't come any better than this, but that's only half the story. The next bit is the art of the exit... not to mention the small matter of it continuing in the right direction.

The bad news is that it doesn't look good for the dollar... or is that good news? I'm never sure any more in this increasingly Orwellian, bad news is good news world we live in.

Melt Your Pennies For Profit

Apparently, the copper contained in US pennies and nickles is now worth more than the face value of the coin.

Apparently, the copper contained in US pennies and nickles is now worth more than the face value of the coin.So it could be a profitable enterprise to cash in your life savings into pennies, melt it down and flog off the metal to scrap merchants in China.

Yeah good idea!! Except it could land you in the slammer.

The best ideas are always illegal :(Effective today, the U.S. Mint has implemented an interim rule that makes it illegal to melt nickels and pennies, or to export them in mass quantities.

With the soaring price of copper, a melted-down penny or nickel is now worth more than it would be in its regular state at face value.

Officials at the Mint say in recent months they have received numerous inquiries into whether or not it is illegal to melt coins.

"We are taking this action because the Nation needs its coinage for commerce," said U.S. Mint Director Edmund Moy in a statement.

Meanwhile on the futures, Near month copper is hanging doggedly onto the ~$3 mark. Astonishingly, my pictoral hypothesis from the 7th Dec is playing out pretty close to the mark and now only need a break of support, to attain my copper guru stripes.

Monday, December 18, 2006

Copper To Come A Cropper

Read all about it in this Bloomberg Article

However, in the same article analysts are bullish on Gold and Soybeans:

Folks really are bullish on the gold story and the gold bugs really do put up a convincing case. It's almost so universal I'm tempted to invoke contrarian theory and fade it. Buuuuuut gold can run up awful fast if something happens... options don't look that cheap to me either so I'll be holding off from anything rash for now.SNIP - Next year's commodity winners may include soybeans, which are poised to jump to a 15-year high as U.S. farmers, the world's biggest producers of the oilseed, devote more land to corn.

Gold may extend its rally as the dollar weakens and slowing economic growth prompts investors to seek a haven for their cash. JPMorgan Chase & Co. increased its ``long-term'' price forecast for gold by 9.5 percent last week on expectations for ``robust'' demand.

``Gold's going to be the phenomenon of 2007,'' said Michael Metz, chief investment strategist at New York-based Oppenheimer & Co., which has about $10 billion in assets. ``If I had to choose one commodity, I'd stick with gold.''

Get Fired Up For The Day With A Haka

It works!

Check it out:

Perhaps all the gold bulls could do a haka and scare the crap out of the bears (or visa-versa) and get this thing moving. Just tell me which side is haka-ing so I can position myself on their side. lol

Gold Makes It to Wallstrip

It's reminded me that I've been remiss in mentioning gold, apart from the odd quip here and there. Why? I suppose from a trend trading standpoint I am a bit underwhelmed with the pattern at the moment. I don't see anything that would have me plonking on the futures with a trend trade and I don't like the IV setup at the moment for any short gamma option trades.

It doesn't mean I've ignored it, Oh no, it still has useful little swings for taking short term trades, so yes have been jousting away at it. I note Howard has got in at a good spot though and Bill Rempel also has a well thought out article on his blog today and faces off the bulls.

Long term... hey, I don't know I'm just a trader. Both sides have strong arguments and I follow along pretending to understand all the concepts, but as a private trader I'm primarily a hitch-hiker, I'm just draw my lines and try to catch a ride whichever way it's going. At the moment I have no idea which way, so it will be tilting at windmills for me for the moment.

Friday, December 15, 2006

When They Sell Silver...

...they really don't mess around. As it stands at this moment, silver is down >7%.

...they really don't mess around. As it stands at this moment, silver is down >7%.That is a big move in one day and represents a few dollars under $5,000 PER CONTRACT. Longs will nevertheless be happy with their gains since the October low, but it's still a lot of money to give back. (presuming not liquidating)

Gold has also put in a bearish day, being down a point and three quarters.

It could have a lot to do with the US dollar which has been staging a rather impressive recovery over the last few days. No sign of the dollar doom the bona-fide gold bugs have been getting excited about.

My view on the dollar; if I'm bearish, I'm bearish on all the western currencies, so nil effect in reality. Just the normal turns and round-abouts common in any instrument over time.

Cotton Breaks Out

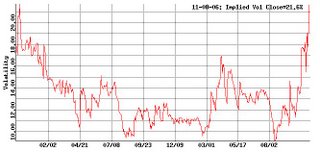

On Tuesday I highlighted some low IV conditions in cotton futures.

On Tuesday I highlighted some low IV conditions in cotton futures.We are now looking at a breakout of a bit of a ragged basing pattern and including Tuesdays big up day, this looks pretty bullish.Snip from Tuesday:

Well, yesterdays bar might have the bulls sitting up and paying attention, but ostensibly sideways.What is of interest to option traders is the multi year lows in implied volatility. In the last few days, IV mean has finally decided to collapse below 20% to basically be on a par with statistical volatility, making them look like fair value for the first time in quite some time.I wouldn't go calling them cheap or underpriced, but buying could finally be considered in my opinion

Options at fair value and at multi year IV lows looks like pretty good conditions for a straight out plonk on calls in my opinion.

Wednesday, December 13, 2006

Kopper Kwicky

Chart

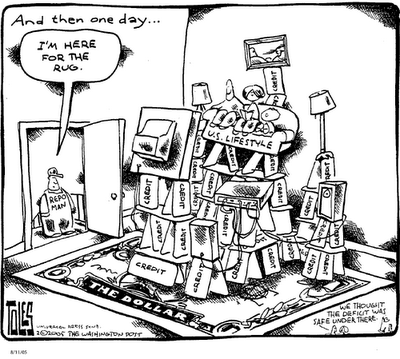

Death of the Dollar?

I post it here for interest only, and do not necessarily endorse his comments. However it is topical in light of the recent dollar dumpage.

Analysts Bearish on Base Metals

2007 Expected Commodities Price Changes

The table below highlights the consensus opinion on where commodities prices will go in 2007. The estimates are from numerous analysts polled by Bloomberg. The expected percent change for each commodity is calculated by the difference in the year-end 2007 consensus and the current price. Interestingly, the only three commodities that are expected to rise in 2007 are the three tracked mostly by the mainstream media -- oil, natural gas, and gold. All other commodities are expected to decline, with lead expected to fall the most.

Tuesday, December 12, 2006

Cotton - Low Volatility Heads Up

Orange Juice - The Bear Approacheth

Then... yesterdays 9.75c dumpage:

Now, as is obvious in this 5 year continuous chart, it is insignificant and not even enough to get near any trend lines one might draw in... not enough to be even immediately visible on this chart.

However, the fundamental news which precipitated this fall could be significant:

The U.S. Agriculture Department's monthly supply-demand report pegged Florida's

2006-07 citrus output at 140 million (90 pound) boxes, up from the 135 million

projected in its October report, which is a 17-year low.

The trade had been

expecting the data to be flat to 3.0 million boxes lower and were surprised by

the USDA's increased estimate.

"We were pricing in a smaller crop. Instead,

it got bigger so you saw people bail out like crazy," a dealer said. ===>>More<<===

Trends *usually have some underlying fundamental/sentiment reason for reversing and I reckon this could be it; so I'll be looking to see how this develops and perhaps for a low risk opportunity to short.

For the moment, just a heads up.

Monday, December 11, 2006

Cocoa Bull Going For A Romp

On December 5, I pointed out on this blog some overpriced volatility on Cocoa Futures, and suggested that selling some premium over this contract could be a good idea.

On December 5, I pointed out on this blog some overpriced volatility on Cocoa Futures, and suggested that selling some premium over this contract could be a good idea. Friday, December 08, 2006

How to Prove Yourself Right About Crude

However there is a way to prove yourself right about a call.... well two ways actually.

1/The first method is to aquire a television or radio program, make a plethora of predictions, and then only highlight the winners. This method is already well known and suffers frequent exposes' from on-the-ball bloggers and other citizen journalists. (You know who you are ;-) )

2/The 2nd method requires a little more effort but it's worth it if one wants to attain guru status on the cheap. Make an initial prediction and then change that prediction as events dictate. This way the original call for oil to go to $67 before Christmas, can metamorphose into a call for oil to tank to $47 by Halloween if necessary; claiming that the realized scenario was what was really meant all along. lol

Anyway, lets have a look.

Anyway, lets have a look.Before we start, lets get one thing clear. I think Fibonacci retracements, candlestick patterns and other technical analysis techniques are all bunkum...

...unless of course, they support my hypothesis. lol. So now we have tweezer bottoms at exactly the 38% fib, we have hammers, spinning tops, the whole shebang. We also have a a breakout of the flag/pennant/whatever in the electronic market early this AM.

Far from changing my mind, so far I'm sticking to the original call. But the Gods will not be pleased with this, so I tip my hat to the $64 resistance, perhaps do some burnt offerings; maybe they will turn a blind eye.

Thursday, December 07, 2006

About Copper

Copper is man's oldest metal, dating back more than 10,000 years. A copper pendant discovered in what is now northern Iraq goes back to about 8700 B.C.

The H.M.S. Beagle, used by Charles Darwin for his historic voyages around the world, was built in 1825 with copper skins below the water line. The copper sheathing extended hull life and protected against barnacles and other kinds of biofouling. Today most seagoing vessels use a copper-containing paint for hull protection.

Paul Revere, of Revolutionary War fame, produced the copper hull sheathing, bronze cannon, spikes and pumps for the U.S.S. Constitution, known as "Old Ironsides." Revere was one of the earliest American coppersmiths.

The boilers on Robert Fulton's steamboats were made from copper.

One of the famous Dead Sea Scrolls found in Israel is made of copper instead of more fragile animal skins. The scroll contains no biblical passages or religious writings - only clues to a still undiscovered treasure. ===>>MORE<<===

So where are we going with copper?

So where are we going with copper?Well after that tremendous run up that climaxed in May of this year, copper has been in a retracement/consolidation/triangle with what appears to be key support at around $2.97.

My hypothesis based on todays action is that we again test that $2.97 support and see what happens there.

I leave public predictions out of the picture for a while and wait to see if I'm a guru or a bum on my oil call (which was not all that serious by the way, I'm not a predictive trader).If she blows through support, there are not a lot of technical levels to trade from. I won't say it would go all the way to the next obvious support levels, but stranger things have happened. Folks are so universally bullish on the China/base metals story, it's almost a classic fade.

It will be interesting to see the effect on stocks suck as Freeport, Dodge Phelps and BHP if there is a bit of copper tankage.

Wednesday, December 06, 2006

Investing?? In Commodities?

An interesting case for "investing" directly into commodities from Jim Rogers of Quantum Fund fame, and despite my best efforts, I cannot think of the slightest connection between commodities, Jimbo, and any hot looking woman, so no gratuitous photographs for this post (Hey, what about an aesthetically pleasing lass who has obviously done some commodities investing of her own... who cares if her name isn't Emmanuelle Chriqui. Yeah that works) . :-)

Investing in the Commodities Market

SNIP:

Whenever I mention commodities in public, someone always points out that we now live in a high-tech world where natural resources will never be as valuable as they were when we had a smokestack economy. But if you read your history you’ll discover that technological advances are as old as history itself: The introduction of the sleek and beautiful Yankee clipper ship dazzled the world in the mid-nineteenth century, loaded with cargo, sailing down the trade winds at 20 knots and more, averaging more than 400 miles in 24 hours and able to make it from U.S. ports around Cape Horn to Hong Kong in 80 days; within a decade, the clippers had been replaced by the steamship, no faster but not dependent on wind power; and before long the next big thing in transport had taken over, the railroad, which, of course, was the original Internet - and prices in the commodities market still went up.==>>MORE<<==

I've never thought of commodities as an "investment" vehicle, apart from rare cases such as Crude Oil as we coast down the wrong side of Hubberts Peak. I've always considered them as a trading vehicle... find an opportunity, exploit it, and get the hell out... just like any normal business. I can make an excellent case of commodities over stocks in this regard.

But an investment? An interesting case put forth by Jimbo, but I don't buy it. An investment to me is something you can stash in the bottom drawer (or the scrip, or bill of sale anyway) and forget about for a while, like a Google IPO or those Goldman Sachs shares bought last century.

The long term charts of most commodities don't inspire me to do this, but hey, anything to keep the liquidity up is fine by me.

How To Prove Yourself Wrong About Crude

Proving yourself wrong is a relatively easy thing to do in the commodity markets (or any market for that matter). Simply make a public prediction. lol

Proving yourself wrong is a relatively easy thing to do in the commodity markets (or any market for that matter). Simply make a public prediction. lolThe Gods will ensure that said prediction goes spectacularly wrong, particularly when accompanied will self-assured arrogance and self-aggrandizement. Which is why I'm trying a bit of humility and self-deprecation, perhaps this will appease the trading Gods.

Anyway as detailed in the days succeeding the US mid-terms, I'm bullish on oil and remain in a convoluted tangle of option legs which I'm pretty sure is bullish lol. In fact oil is the only market followed by the great unwashed masses (a.k.a. those people who believe all they hear on BubbleVision, a.k.a. the mums and dads) that I'm actually bullish on.

As a further offering, I haven't even put a lot of thought into this and will be short on verbosity. So here goes:

Oil is in a bullish pennant, has bounced of 38% fib retracement level and is set to go to ~$67 before Christmas in a measured move.

That's it.

Trading Gods, do your stuff!

Cocoa Addendum

Cocoa: Trouble in Cote d’Ivoire and Ghana

Political problems have plagued West Africa including the Cote d’Ivoire and Ghana for years now. Cocoa producers in these two major producing countries (60% of world production combined) also have to contend with diseases to their crops, namely the swollen shoot virus. This virus defoliates and can potentially kill cocoa trees in many parts of West Africa. According to a BBC News report on October 13, 2006, some cocoa plantations have been abandoned as the virus continues to spread. The increasing costs of fertilizers (derived from petroleum) and the high cost of anti-virus sprays combined with low prices for cocoa on the open market have made it difficult for farmers to maintain their crops. ===>>More<<===

While this news doesn't appear to be a new revelation, it's worth keeping in mind.

Tuesday, December 05, 2006

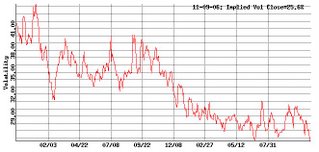

Cocoa Implied Volatility

...is up in the upper reaches of it's yearly range at around 29-30% at the ATM strikes with a nice volatility smile in the near expiries.

...is up in the upper reaches of it's yearly range at around 29-30% at the ATM strikes with a nice volatility smile in the near expiries.By contrast, statistical volatility has been grubbing along at about 20% for 2 months. IV's are well in excess of 10 points higher tan SV in the OTM strikes, so unless we are anticipating a sudden spike in realized volatility, it seems like a good time to me to write some options.

I wouldn't dare suggest which side to write or indeed that one should write options at all(risk disclaimers an' all that), but looking at the history of this time of year in the cocoa market, there seems to be more risks on the upside, which of course is reflected in the skews. I'll be watching to see if the resistance around about here turns out to be resistance.

I have no position here yet, just a heads up.

Holy Crap, Holidays are Expensive!

I already knew that. You already knew that too. I just felt I to confirm that particular theorem by going on another one. Free accommodation provides no relief from the inevitable diminution of the bank balance as the theorem (which surprisingly, is nameless) provides other methods of totally unnecessary expenditure.

I already knew that. You already knew that too. I just felt I to confirm that particular theorem by going on another one. Free accommodation provides no relief from the inevitable diminution of the bank balance as the theorem (which surprisingly, is nameless) provides other methods of totally unnecessary expenditure.If you are wondering what a photo of Christie Brinkley is doing a here. It seems to be what all financial bloggers do... post a hot photo with the most tenuous link to the topic at hand (in this case the fact that Christie appeared in National Lampoon's Vacation lol) in a cynical attempt at getting search engine hits... great idea! lol

Anyhow, I'm back now in the safe confines of my cave, ready to do battle with the market Gods once again... and I need to do so in Ernest; what with Christmas approaching an' all. :-o

Tuesday, November 28, 2006

I Think, Therefore I Am

I am actually on the road at the moment; a mission to remind my relatives why they should not visit me for extended periods... achieved with minimal cost by me visiting them. lol

So sans the luxury of my office, multiple monitors, broadband connection, etc, my blog offerings will reside more in the whimsical than the rational for a few days... if indeed, my posts are ever rational.

*So in keeping with the esoteric theme, some musings on Gann, time & price from an old internet adversary and flame warrior, Grant MacDonald. Well past me I'm afraid, but this guys views are always challenging to the prevailing dogma, and therefore interesting.

*Not exactly esoteric, but mysterious nonetheless, Adam Warner shads some light on the workings of the VIX over the last few days. Here, here & here.

*As a token commentary on the futures markets, coffee is looking bullish once more, prompting some interest from at least one brokerage blog.

*The stock indicies and the Dollar Index are keeping things interesting for economic prognosticators (*click any financial link for comments on that)

Cheers

Friday, November 24, 2006

Dollar Dazzler

Not too long ago, I saw a video of a presentation by Larry Kudlow that was floating around the web. Basically he was a lone Dollar bull in a hostile room full of bears. He put on a great show, and was even quite convincing. But nobody believed him anyway. lol

Not too long ago, I saw a video of a presentation by Larry Kudlow that was floating around the web. Basically he was a lone Dollar bull in a hostile room full of bears. He put on a great show, and was even quite convincing. But nobody believed him anyway. lolI'm not formally educated in economics so I rely on articles and opinions that are sufficiently dumbed down enough for me to understand. So what I'm saying here is I'm no expert, not even well versed in the principles of economic managent.

But I must say I am most impressed by the case presented by the bears... both on the dollar and on the economy (that includes us in the rest of the English speaking world as well).

So I guess I'm saying that I'm not shocked that the DX is testing some important support levels on the chart. My only lament is not taking the trade.

So I guess I'm saying that I'm not shocked that the DX is testing some important support levels on the chart. My only lament is not taking the trade.Where my bemusement lies is in the the stock indice's, where apparently any news is good news, so long as rates stay paused... a slowing economy is apparently bullish... but I won't put the kibosh on that one.

Thursday, November 23, 2006

Gold is Just a Commodity

Pressure grows on IMF to sell some gold stores

SINGAPORE: The International Monetary Fund, one of the world's largest holders of gold, should sell some of its hoard to cover projected operating losses, say a growing number of the fund's executive directors.

The Washington-based lender predicts that it will lose $87.5 million next year and $280 million in 2009. Some directors say the fund should sell a portion of its 103 million ounces of gold, which are valued at $64.7 billion, and invest the proceeds in interest- bearing assets.

"We would support the use of fund gold as part of the solution to IMF financial needs," Tuomas Saarenheimo of Finland, chairman of a group that coordinates the position of European Union members on the fund's 24-member board, said during an interview in Washington.

The prospect of gold sales highlights the crunch faced by the fund as countries like Uruguay repay loans early, reducing interest income, and demand for fresh credit ebbs. Proponents must overcome opposition from the United States, the biggest owner of gold, which wants to keep prices high.... MORE ====>>

Wednesday, November 22, 2006

Real Money?

I don't know how many arguments I've sat through between the antagonists and protagonists of the "Gold is the only true currency" dogma. In such instances I feign some sage-like loftiness as to being above such materialistic concepts (when in reality the discussion is well over my head, I don't have a clue. lol)

I don't know how many arguments I've sat through between the antagonists and protagonists of the "Gold is the only true currency" dogma. In such instances I feign some sage-like loftiness as to being above such materialistic concepts (when in reality the discussion is well over my head, I don't have a clue. lol)I can only default to my observations; sometimes it acts like a currency, sometimes like a commodity. In the last few months at least, the reverse correlation to the USD index is quite striking, as per the chart on the left.

Without drawing all those tiresome lines all over the chart, technicians will recognize the short-term trading signals (all depending on time frame and style of course), long gold, short the dollar index.

So the question today is, whether to take both trades, or is it really the same trade? Is long gold really short the dollar by default?

For now, my thoughts are kill two birds with one stone, and gold is sexier than USD's, so I'm with gold, and hoping for a breakout of the recent highs.

Tuesday, November 21, 2006

A Nuclear Winter in Base Metals?

A good time to dive into a 25 page PDF on base metals I found on Kitcometals titled:

The Coming Nuclear Winter Base Metals

It's a view I broadly subscribe to and despite the unpleasant imagery in the title and some arguable assertions in the text, an interesting read for the holders of base metal miners like FCX/PD, BHP, TCK and the like.

Check it out.

Monday, November 20, 2006

Lean Hogs

Last Wednesday I was having a look at a possible "resistance becomes support" scenario in the February Lean Hogs.

Last Wednesday I was having a look at a possible "resistance becomes support" scenario in the February Lean Hogs.In fact hogs have moved nicely off that level to become a textbook example of this nuance of price action. The fib retracement traders will also be claiming this one as well as it is in the 50% retracement region that most look for. I'm hoping at this stage that price action holds up long enough to for this to be a textbook example... and anyone long some calls will appreciate that too. :)

Not withstanding that resistance often does often become support, I never have had a satisfactory answer as to why this happens. It's good enough for me that it just works as far as trading goes; but the vacant stare on my face is not a good look when someone asks me this very question.

Anyone with an answer? I'd be much obliged.

Not So Fast With The Price Rise Mr Barista

Last week I opined that I would really have to get my trading act together to cope in the potential price rise at Mrs's favourite cafe'. A happy wife is a happy life, so rather than put the khyber on her cafe' society spending, I'll just have to step up my trading performance.

Last week I opined that I would really have to get my trading act together to cope in the potential price rise at Mrs's favourite cafe'. A happy wife is a happy life, so rather than put the khyber on her cafe' society spending, I'll just have to step up my trading performance.That must mean even more trend-lines right? LOL

Thursdays bar was a grade A reversal, with some solid resistance at the ~125 level for this contract* (not shown on this chart) triggering some solid selling to close lower for the day.

*N.B. Drawing horizontal trendlines can be a challenge with futures because of the cost of carry/contango/backwardation. What mat be a lovely support or resistance on the individual contract, might not be valid on a continuous chart and visa-versa. So a grain of salt is required.

Friday saw the month old trend-line broken with conviction but with some buying off the lows and closing above the August resistance areas (now support?)

My view of support and resistance goes something like this: Support (resistance) isn't support until there is support. In other words, I am watching price action around these arbitrarily drawn lines on the chart for low risk entries (or pyramiding opportunities).

So is there support at the support in this March

coffee contract. There is some evidence but no "case closed" yet, and there's still the fib levels below here.

coffee contract. There is some evidence but no "case closed" yet, and there's still the fib levels below here.The next question is, is whether this market is in an "El Toro Grande" ( To steal Stuie Johnstons terminology) or just trading within a somewhat messy range?

It is a question that can only be answered with certainty, in retrospect: But one must put their chips on the table.... and if Alfredo the Barista is going to end up charging a fiver for a cup of coffee, I am going to slap that fiver on the counter with fiscal impunity, dammit!

Friday, November 17, 2006

Bugger Commodities

Marketwatch: Nymex IPO rallies more than 100%

NMX135.95, +76.95, +130.4% ) IPO is up more than 100% after opening at $120, above its $59 price. The stck gained strength in the open market by rising to $140 a share. The performance marks the best opening-day gain by a U.S.-based new issue since Transmeta (TMTA :Nymex is the exchange where the energy and various metals contracts trade. I wish I had bragging rights for having subscribed to this, bus alas, no.transmeta corp del com

Whither To, Copper?

Copper has undoubtedly been one of the big stories in recent commodities boom, due in no small part to the China story. Many analysts are predicting a perpetual bull in the base metals because of the increasing demand from China and other Asian economies.

Copper has undoubtedly been one of the big stories in recent commodities boom, due in no small part to the China story. Many analysts are predicting a perpetual bull in the base metals because of the increasing demand from China and other Asian economies.I've never been so sure. The cycles in these things always seem to have their way in the end.

The question with copper (and other base metals) is; It this the end for now? It is often remarked that base metals are a good barometer for the health of world economies and as such, things look a tad shabby technically. There was an important technical break-down only a few days ago, to arrive at this point of possible support. (well, we're a few ticks above it)

What copper does here will probably say a lot, particularly about copper, but about the the perpetual economic growth dogma that prevails today. (If the economic barometer thing is to be believed)

On the other hand, it could just be speculative heat coming out of the market.

Either way, it's do or die for copper right about here.

Thursday, November 16, 2006

Train Stories

Freight Train of the Day

Frozen Concentrated Orange Juice - Getting very close to the all time high today, closing up 8.55c @ 205c on the January contract. This is a commodity that was around 50-60c in 2004 so anyone with a trend following system and nice wide trailing stop is making a motza out of this contract. Sad to say thats not me.

Train Wreck of the Day

Crude Oil - This is a market that many traders say should be rallying... including me :( My "glitch" turned out to be a derailment. As luck would have it, it happens to be the most dreadful looking chart of the energies. Unleaded, Heating Oil and Natural Gas maintain their basing patterns whereas the bottom has dropped out of crude. I still maintain a position with some adjustments to further limit losses while maintaining upside potential.

Dollar Update - Bullish?

Well at least not bearish. It looks at this stage to be supported @ 84.50 and has edged sideways out of the channel I have drawn in.

Well at least not bearish. It looks at this stage to be supported @ 84.50 and has edged sideways out of the channel I have drawn in.I'm a bit questioning of the Bull case here because of the technical picture of the basket of currencies the USD Index trades against. They either look bullish or look to have support in most cases.

I'm not really convinced, so no position in the USD.

The Aussie however, looks like a nice long setup. (Dynamically updating chart)

Oh No! Please don't say coffee is going up!

Could we be looking at yet another big commodity bull in coffee?

Could we be looking at yet another big commodity bull in coffee?London Robusta coffee has been in a solid uptrend since August that was not replicated in the New York Arabica contract... until late last month.

A big bullish bar off the double bottom punched through the downsloping resistance, launching quite a strong move upwards.

I was expecting a bit more retracement as a spot to possibly to some pyramiding, but yesterdays move off the trendline looks incredibly bullish. I just don't know whether its a good spot to add. But a strong bull doesn't hang about to offer traders a nice comfortable entry... case in point; corn.

If this takes off, so will volatility, so optioneers might want to get long some vega.

I am however, bracing myself for a price rise at my wife's favourite coffee shop. It might just cost me all my profits from trading this contract. :-o

Treasuries and the Yield Curve

It seems that the bond market is saying "hard landing" as stocks say: "What, me worry?"One of the reasons I think the stock market looks a bit frothy.

Plenty of irony in the comments too. :)

Wednesday, November 15, 2006

Lean Hogs - Resistance becomes Support?

Lean Hogs have sold off quite viciously from the highs of this month - a classic headfake out of consolidation and selloff, described as a train wreck by Jim Wyckoff.

Lean Hogs have sold off quite viciously from the highs of this month - a classic headfake out of consolidation and selloff, described as a train wreck by Jim Wyckoff.I wouldn't go that far(yet) as this Feb Hogs chart looks far from bearish in my opinion. If Hogs get support here, it will be at a previous resistance level and at ~50% fib retracement. If this is just a retracement, then it is right here where we want to see support... or 63.77 at the lowest.

It's a tad early to call a long opportunity, but just a heads up. IV's are on the cheapish side so optioneers might be looking on the buy side of the equation.

Tuesday, November 14, 2006

BUY DIPS!

As the S&P 500 hit new highs again, at this point, that backspread strategy made a lot of sense. It has allowed me to be wrong, but right anyway.

As the S&P 500 hit new highs again, at this point, that backspread strategy made a lot of sense. It has allowed me to be wrong, but right anyway.I keep thinking I have stumbled into some parallel universe where normal market behaviour has been suspended and any news sends the market higher. Good News is obviously good news. Bad news, is also apparently good news. A slowing economy is bullish.

Shades of Animal House.

T-Bond Top?

U.S. T-Bonds Up Against Stiff Overhead Resistance

Dollar - Which Way?

Last Friday, I mused that the US Dollar Index was at a pivotal juncture with regards to the technical picture.

Last Friday, I mused that the US Dollar Index was at a pivotal juncture with regards to the technical picture.Pivotal was the correct term, because thats exactly what it did at the support I had drawn in - pivot. This isn't necessarily bullish... yet. There is a month old downward channel to contend with as drawn in on the left. That horizontal support at 84.50ish is still key and a move out of this channel will validate that support and essentially set a bullish path in the medium term.

On the other hand, most of the currencies the USD trades against look technically bullish as well. A move down today continues the channel.

Which way?

Monday, November 13, 2006

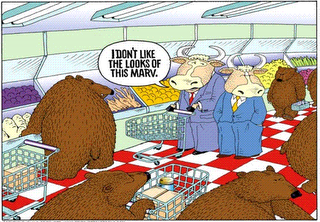

VIX Deceased

I have mentioned in earlier posts that I have stopped looking at leading indicators such as put/call ratios, VIX etc as they stopped making any sense, sans any sort of normal wave structure in the stock indicies.

Only one thing made sense - buy dips; not retracements, they don't exist anymore, dips. Any dip!

Old habits die hard, so today I once again perused the VIX for any sign of activity, to find that, ironically, it slipped away in the night, unnoticed by anyone.

Anyway, nobody needs me to tell them that S&P 500 IV's are at basically their minimum value. We have not seems them much lower... ever. Adam Warner has discussed VIX at length over at The Daily Options Report, so have a look there for a comprehensive run-down.

Minimum value is a concept I like to use in the commodities markets. When cocoa producers start burning there crops in the streets as they did a few years ago in the Ivory Coast, it's time to take a position.

So can that logic be extended to stock market volatilities? I think so, but cautiously so, as all logic has apparently been suspended. Buying cheap volatility, of course means buying puts, because it is from downside where we will get a lift in vols.

Hmmm well there is that potential double/triple top.... the election is past.... the bears are looking a bit more credible.

However, the bobbleheads are talking up a storm (as ever), oil refuses to rise despite my best analysis, and apparently a slowing economy (and therefore a pause) is bullish!

Confounding!

There is a strategy that suits low volatilities, is long vega on the downside and can be profitable even if the SP goes up - the "reverse ratio spread" (aka "put backspread"). We short ITM puts and buy OTM puts in a ratio (usually 2:1 but can be any ratio... 3:2, 3:1 whatever)

The risk is similar to a long straddle and maximum loss is at the bought strike.

I'll talk more about this in the coming days as we watch how this market shapes up.

Cracks in Copper

They will point to the fundamentals of ever increasing demand and dwindling supply. The opinions of one Jim Rodgers gives them great heart and courage of their convictions.

They could be right, but I'm not a believer on two fronts. 1/I think we are headed for a recession (I will leave the argument on that front to more formally educated pundits) and 2/ Psychologically I don't want to be a believer in anything. I just want to trade what I see, without bias.

Which brings me to the point of this post - Copper.

Which brings me to the point of this post - Copper.Many view copper as a barometer for the global economy and particularly, a barometer for the health of the China economy. I don't necessarily agree with that, but it has to be a barometer for something. As such Fridays price action must surely be viewed as a shot across the bow of whatever copper is a barometer of.

I don't follow the base metals not tradable on the US futures markets, (such as zinc, nickel, lead etc) but apparently they have taken a bit of a hit as well.

Anyway, I think it is technically significant, and copper on the electronic market is down further this morning, the Dec contract trading a short time ago at 302.50. Base metal bears may now have something to put the wind up all those relentless bulls.

Early days yet.

Saturday, November 11, 2006

Rolling Futures Contracts

Bill over at NoDooDahs was asking in a comments thread below about when it is prudent to roll your position from one contract to the next.

Bill over at NoDooDahs was asking in a comments thread below about when it is prudent to roll your position from one contract to the next.The basic answer is to know when the notice period starts (for physical delivery contracts) or to otherwise keep an eye on open interest and volume.

We have an example occuring at the moment in Cotton, and it helps to see the charts to see exactly what is happening. The 1st notice day for Dece

mber delivery is November 22, as detailed at the NYBOT. So any speculative traders not intending to participate in delivery had better be out of the December contract by then. We can see in the charts that this is already occurring.

mber delivery is November 22, as detailed at the NYBOT. So any speculative traders not intending to participate in delivery had better be out of the December contract by then. We can see in the charts that this is already occurring.Open interest in the March contract has now overtaken OI in the Dec and for all intents and purposes, March is now the spot contract. Traders are either starting to roll out now, and/or initiating any new positions in the March contract instead.

For a trader, liquidity is paramount in avoiding slippage as much as possible, therefore you wouldn't want to let volume and OI dry up too much before rolling out. It's a judgement call that can be affected by when you anticipate exiting the trade. If an exit is imminent for whatever reason, you wouldn't want to be flipping contracts and incurring costs for no benefit.

If I was in a position trade in the Dec contract here, and anticipated holding the position for a bit longer, I would be looking to roll out at any time now. The exact timing is not usually of any consequence in this situation.

Interestingly, cash settled contracts OI behave the same way. Dec Lean Hogs, a cash settled contract, trade right up till the 14th of December (more than a month left to trade), yet the Feb contract now has higher OI (see charts here). Obviously a close eye on OI and volume is requires here also.

Friday, November 10, 2006

A Slight Glitch in My Crude Oil Hypothesis

This has put a bit of a dampener on all of us who are long Crude with what seems to me to be a veiled projection of an approaching recession. I'm quite prepared to go along with that scenario, but I still see other upward pressures on Crude; not the least of which is the prevailing US foreign policy, either directly or indirectly. I don't think the Democrat win in the mid-terms will change much on that front.

I'll be staying long, and options are cheap enough to put a floor under the price action.

US Dollar Index

There has been much discussion about the future of the dollar in recent years, mostly based on the fundamentals of the US economy, inflation, interest rates, money supply, whatever.

There has been much discussion about the future of the dollar in recent years, mostly based on the fundamentals of the US economy, inflation, interest rates, money supply, whatever.My simplistic view is bearish. However the maladies afflicting the dollar are also endemic in the other western currencies... particularly the anglosphere.

In cases where I haven't really got a clue, which pretty much includes everything, I'll just resort to charts. lol

Technical analysis can be an extremely subjective study at the best of times, as is this look at the US dollar. Depending where a traders draws support/resistance, trendlines etc can give completely different pictures. The dollar has either broken support or is sitting at support, depending on which line you want to believe.

Either way, I think we are a pivotal juncture in the dollar, and the next few days could reveal the medium term future of such.

I'll be keeping an eye on it. Stay tuned.

More on the S&P 500

Dare we call it a top?

I stopped looking at leading indicators on the SP about 6 weeks ago, once I twigged there was a US election approaching.... indeed, I stopped looking at any sort of indicator at all. The only strategy that was working was:

Buy Dips!! lol

But the technical pattern I mentioned in the previous post is not being lost on the rest of the trading community either (Well of couse not! Sharp as tacks all you lot :) )

I was going to post some charts and analysis on the SP, but it has already been done in exemplary fashion by other bloggers such as Trader Mike. Rather than repeating that in my own words, best to go to Mike's blog where he asks this question - Can You Say Distribution? - and discusses exactly what we've all been thinking.

With the political imperative for a rising stock market now passed, it will be interesting from an analysis point of view, to see what happens next.

Put options are cheap too, and long vega is an attractive proposition, should a correction be in the cards.

Thursday, November 09, 2006

It Can't Be True; Can It?

I mean, this Stock market has slain the bears, humiliated all but the most stubborn of them into a morose subserviance. This market is going up forever, without ever having to worry about retracements ever again, with VIX gang-nailed to the floor

Well that's how it was looking up till the election... oh crap! That's my cynicism coming out again.

I'll have a look at indicies over the coming days for some signs of normality, maybe even dust off my bear suit. lol

Oil Can Now Rise!

Well now that the US mid-term elections are out of the way, there is now no compelling and urgent reason for the price of crude oil down be under $60.....

Well now that the US mid-term elections are out of the way, there is now no compelling and urgent reason for the price of crude oil down be under $60..........oops! Did I insinuate something there? Nah! I'm sure it was just normal market forces :)

Anyway, Oil has broken out of its downtrending channel (with Unleaded and Heating Oil looking similar) as indicated on the chart.

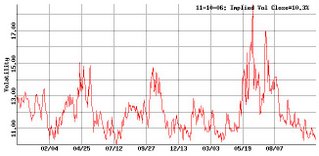

IV is rock bottom of its two year range at 26% and with Statistical Volatility at 31%, options look cheap here. Any long vega, long delta strategies look good to me.

Feeders - IV Breaks Out

Feeder Cattle Implied Volatility mean has made a 2 year high at over 21% yesterday on the back of some fairly serious tankage over the last 2 months.

Feeder Cattle Implied Volatility mean has made a 2 year high at over 21% yesterday on the back of some fairly serious tankage over the last 2 months.There is something important to note here in that IV's were at 2 year lows two months ago also. Some sort of long vega strategy would have done very well if the direction was picked correctly or if delta was neutral. IV has doubled in that time.

The other thing to note at present is that though the Statistical Volatility is relatively high at 14%, this is substantially lower than the IV.

The other thing to note at present is that though the Statistical Volatility is relatively high at 14%, this is substantially lower than the IV.If a trader believes that the volatility on the underlying may peak about here, or even decline, a good case could be made for this being at, or close to an IV peak here. An ideal spot to go short vega, or in other words sell some option premium.

Looking at the price chart, a firm conviction of where price is headed (or not headed) would be required also. Not a lot of lead from the skews though.

Just a heads up. as ever do your own research

Wednesday, November 08, 2006

Selling Some Premium on Grains

Time to lighten off some gold as well.

Payday

Corn making new highs...

....again, causing much whooping and hollering in the Avalon trading room....again.

Elsewhere there is a lot of bullishness on corn as well. Peter Korda od Slipka Financial Partners has made a pretty compelling case for all time highs in 2007 over at The Commodity Trader.

I'm quite happy to agree with him on this point.

Options are carrying a lot of IV so some covered calls might make good sense if this looks like consolidating in the near future, which it doesn't. Wheat has done so over the last couple weeks so who knows.

Thursday, November 02, 2006

WTF am I doing here?

I never thought people were interested in the anonymous writers of trading blogs until a "comrade in arms" showed me the stats on his "about me" page. I must admit to being a bit reticent about waxing lyrical about myself.

I never thought people were interested in the anonymous writers of trading blogs until a "comrade in arms" showed me the stats on his "about me" page. I must admit to being a bit reticent about waxing lyrical about myself.The reason for this is that, as I've gotten older, I've become progressively more anti-ego, anti-snob, anti-bourgeois and more interested in the whimsical and esoteric (as the title of this blog alludes to). Yep, I've turned into a bohemian. A hippie trader. LOL

Yet, the creation of a blog and thrusting at it the world seems so much like an act of the ego. Hmmmm.....

I basically trade the liquid futures markets for a living... Various Commodities, Stock Indicies and Treasuries. If I can do it with an option strategy to limit risk, all the better, but I'm not averse to plonking straight out with futures.

I basically trade the liquid futures markets for a living... Various Commodities, Stock Indicies and Treasuries. If I can do it with an option strategy to limit risk, all the better, but I'm not averse to plonking straight out with futures.I think a diary in the form of a blog helps to organize a rational trading process; if I have a thought, it has to make sense to the 3 people who read this over the next few years. It is also really cool to be part of a community of traders via the "blogosphere", for want of a better word (Gawd howe I hate that word lol).

So starts the experiment.

Gold - Yup! Let's Call it a Breakout.

I called it here . Sure enough, it's broken through the trendline. Very basic TA here.

I called it here . Sure enough, it's broken through the trendline. Very basic TA here.But the gold bugs are all aflutter; with this pragmatic Avalonian fluttering in unison. Something to cheer about while I wait for the stock-market to give a short signal.

Oh wait! The SP500 went down 10 points or so yesterday for the first time in, like 500 days! But I'm waiting for the cavalry to show up, those merciless dip buyers. (or is it the GOP doing all the buying, lol)

Grains Awesome

Dec Corn went limit up briefly today causing a bit of excitement in the Avalon trading room. I've been long grains for quite some time, adding or subtracting contracts as I go along.

Dec Corn went limit up briefly today causing a bit of excitement in the Avalon trading room. I've been long grains for quite some time, adding or subtracting contracts as I go along.Fortuitiously I added some contracts yesterday. Todays action looks sus'... a shooting star for those candlestick enthusiasts. So I took those extra contracts off. Nice enough trade.

Elsewhere in the CBOT grain pits, Soybeans look similar to corn, but wheat looking decidedly weaker.

Not that I'm bearish on the grains, but ferchrissake we must be due a reasonable retracement... unless these markets have decided to copy stocks and go straight up forever.

Thursday, October 26, 2006

Gold Overtures at a Breakout

Potentially, I'll leave profit on the table in exchange for a chance at hitting one over the fence.

Hogs and Cattle are looking bullish too. No position, but wishing I was long and I'm looking for a lower risk long entry.

Kick Off

Maybe about the markets I trade? A lecture on the value of stop losses, money management, technical analysis? As if you all haven't been beaten over the head ad infinitum with all that already!

How about a psychological analysis of why traders feel compelled to tell the world about their trades? Well I don't have a clue why I'm doing this.

How about a Chicago wheat chart? Yeah that will do, because it shows what every trader is trying to catch when pouring overtheir charts... and this was a particularly nice one. The question at the moment is this: Is it all over! Should we take our chips and go and have a festive evening with friends and a bottle of Dom? Or should we keep the chips on the table and let it ride?

How about a Chicago wheat chart? Yeah that will do, because it shows what every trader is trying to catch when pouring overtheir charts... and this was a particularly nice one. The question at the moment is this: Is it all over! Should we take our chips and go and have a festive evening with friends and a bottle of Dom? Or should we keep the chips on the table and let it ride?The traders dilema epitomized!