I have mentioned in earlier posts that I have stopped looking at leading indicators such as put/call ratios, VIX etc as they stopped making any sense, sans any sort of normal wave structure in the stock indicies.

Only one thing made sense - buy dips; not retracements, they don't exist anymore, dips. Any dip!

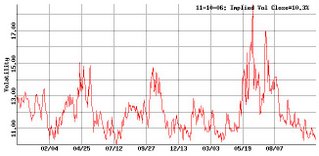

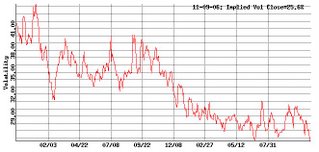

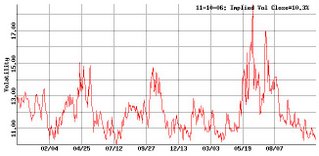

Old habits die hard, so today I once again perused the VIX for any sign of activity, to find that, ironically, it slipped away in the night, unnoticed by anyone.

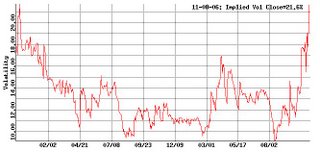

Anyway, nobody needs me to tell them that S&P 500 IV's are at basically their minimum value. We have not seems them much lower... ever.

Adam Warner has discussed VIX at length over at

The Daily Options Report, so have a look there for a comprehensive run-down.

Minimum value is a concept I like to use in the commodities markets. When cocoa producers start burning there crops in the streets as they did a few years ago in the Ivory Coast, it's time to take a position.

So can that logic be extended to stock market volatilities? I think so, but cautiously so, as all logic has apparently been suspended. Buying cheap volatility, of course means buying puts, because it is from downside where we will get a lift in vols.

Hmmm well there is that potential double/triple top.... the election is past.... the bears are looking a bit more credible.

However, the bobbleheads are talking up a storm (as ever), oil refuses to rise despite my best analysis, and apparently a slowing economy (and therefore a pause) is bullish!

Confounding!

There is a strategy that suits low volatilities, is long vega on the downside and can be profitable even if the SP goes up - the "reverse ratio spread" (aka "put backspread"). We short ITM puts and buy OTM puts in a ratio (usually 2:1 but can be any ratio... 3:2, 3:1 whatever)

The risk is similar to a long straddle and maximum loss is at the bought strike.

I'll talk more about this in the coming days as we watch how this market shapes up.

Last Friday, I mused that the US Dollar Index was at a pivotal juncture with regards to the technical picture.

Last Friday, I mused that the US Dollar Index was at a pivotal juncture with regards to the technical picture.